The Basic Principles Of Estate Planning Attorney

Unknown Facts About Estate Planning Attorney

Table of ContentsThe Best Guide To Estate Planning AttorneyFacts About Estate Planning Attorney UncoveredThe Best Guide To Estate Planning AttorneyThe 6-Minute Rule for Estate Planning Attorney

Your lawyer will certainly also help you make your files official, scheduling witnesses and notary public trademarks as essential, so you do not need to bother with attempting to do that last action on your very own - Estate Planning Attorney. Last, however not least, there is useful tranquility of mind in establishing a connection with an estate preparation attorney who can be there for you in the futureBasically, estate preparation lawyers offer value in several methods, far past simply giving you with published wills, counts on, or other estate intending papers. If you have questions concerning the procedure and intend to discover more, contact our workplace today.

An estate planning attorney assists you formalize end-of-life choices and legal documents. They can establish wills, establish trust funds, produce healthcare regulations, develop power of attorney, develop succession strategies, and a lot more, according to your wishes. Working with an estate planning attorney to complete and supervise this lawful documents can help you in the complying with eight areas: Estate planning attorneys are specialists in your state's depend on, probate, and tax legislations.

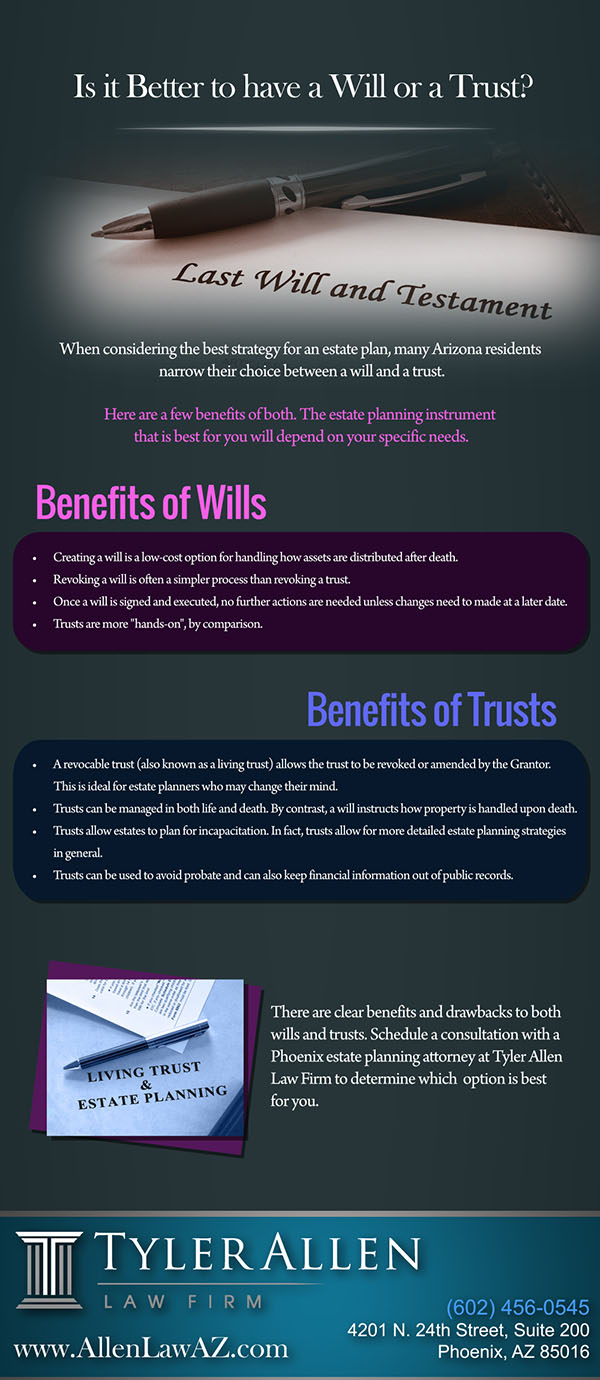

If you don't have a will, the state can determine how to split your assets amongst your beneficiaries, which might not be according to your desires. An estate preparation lawyer can help arrange all your lawful files and disperse your assets as you desire, potentially avoiding probate. Many individuals draft estate planning records and after that ignore them.

Estate Planning Attorney - Truths

As soon as a customer dies, an estate strategy would certainly determine the dispersal of possessions per the deceased's instructions. Estate Planning Attorney. Without an estate plan, these decisions may be left to the near relative or the state. Responsibilities of estate coordinators include: Creating a last will and testament Setting up trust accounts Calling an administrator and power of lawyers Recognizing all recipients Naming a guardian for minor youngsters Paying all financial debts and minimizing all tax obligations and lawful charges Crafting instructions for passing your worths Developing preferences for funeral arrangements Finalizing guidelines for care if you become unwell and are incapable to choose Obtaining life insurance, handicap earnings insurance, and long-term care insurance policy A great estate plan need to be updated on a regular basis as clients' financial scenarios, personal inspirations, and federal and state regulations all progress

As with any type of profession, there are attributes and skills that can assist you accomplish these goals as you collaborate with your clients in an estate planner function. An estate planning job can be ideal for you if you have the complying with traits: Being an estate organizer means assuming in the long term.

Excitement About Estate Planning Attorney

You need to help your customer expect his/her end of life and what will certainly happen postmortem, while at the same time not home on morbid thoughts or emotions. Some customers might come to be bitter or distraught when considering fatality and it could be up to you to help them with his response it.

In case of death, you may be expected to have various conversations and ventures with making it through relative regarding the estate plan. In order to excel as an estate coordinator, you might need to walk a fine line of being a shoulder to lean on and the specific trusted to interact estate planning matters in a prompt and expert way.

tax obligation code changed hundreds of times in the 10 years in between 2001 and 2012. Expect that it has been modified even more ever since. Relying on your client's economic income bracket, which might advance towards end-of-life, you as an estate coordinator will need to keep your client's properties in full legal conformity with any regional, government, or international tax regulations.

Everything about Estate Planning Attorney

Acquiring this qualification from companies like the National Institute of Qualified Estate Planners, Inc. can be a solid differentiator. why not try these out Belonging to these expert groups can validate your abilities, making you extra eye-catching in the eyes of a possible client. In addition to the emotional incentive helpful customers with end-of-life planning, estate planners enjoy the advantages of a secure earnings.

Estate planning is a smart thing to do no matter of your present wellness and monetary status. The very first important point is to hire an estate preparation lawyer to assist you with it.

The percent of people that don't understand how to obtain a will has actually enhanced from 4% to 7.6% given that 2017. A seasoned attorney understands what information to include in the will, including your recipients and special factors to consider. A will certainly safeguards your family members from loss as a result of immaturity or incompetency. It additionally offers the swiftest and most reliable method to transfer your properties to your beneficiaries.